Financial models are the backbone of a successful startup. They provide clarity, guide decision-making, and inspire investor confidence. In this blog, we’ll explore the key components of financial modeling and why they matter.

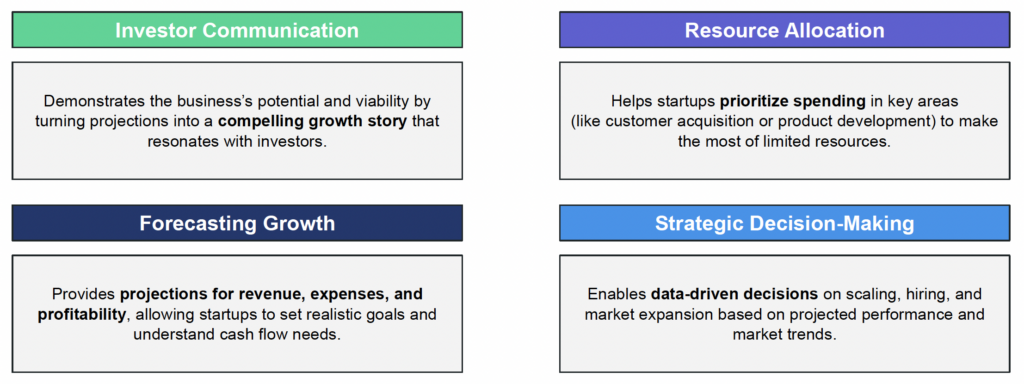

Purpose of a Financial Model

Financial models serve multiple purposes beyond just tracking numbers. They are essential for:

- Demonstrating growth potential and viability to investors.

- Prioritizing spending in areas like customer acquisition and product development.

- Setting realistic revenue and cash flow forecasts.

- Making informed, data-driven strategic decisions.

For instance, if your forecasts show cash flow constraints in six months, you can plan funding rounds or scale back expenses proactively. Each element of the model ties directly to actionable business insights.

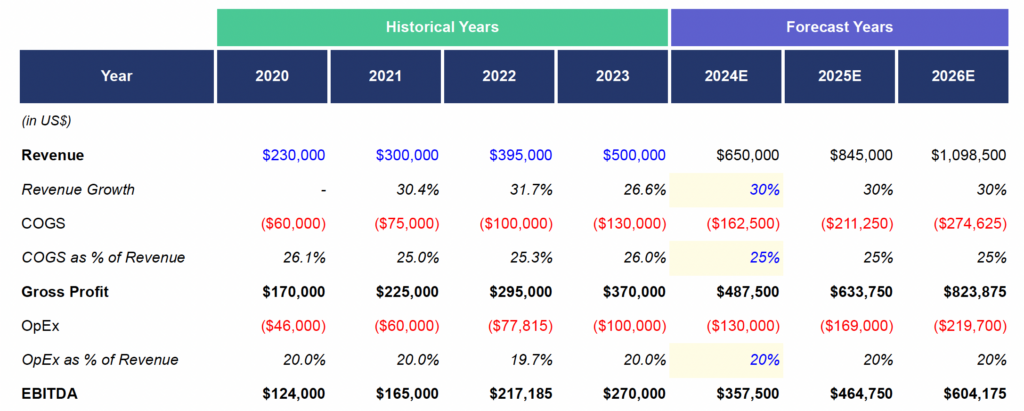

Key Components of a Simplified Financial Model

The financial model provides a clear view of your startup’s operational and financial performance. Key components include:

- Revenue Drivers: Identifying the sources of your sales and growth potential.

- Cost Structure: Breaking down fixed and variable costs to assess operational efficiency.

- Profitability Metrics: Highlighting gross margin and EBITDA margin to measure overall health.

Simplified Financial Model

For example, maintaining a gross margin of 75% over forecast years shows robust pricing and cost control. If margins dip, the model helps identify whether the issue lies with costs or pricing.

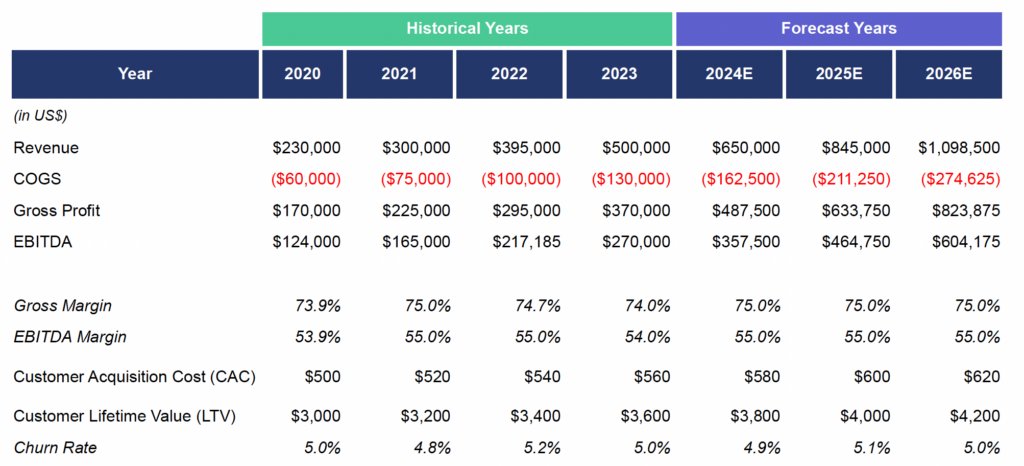

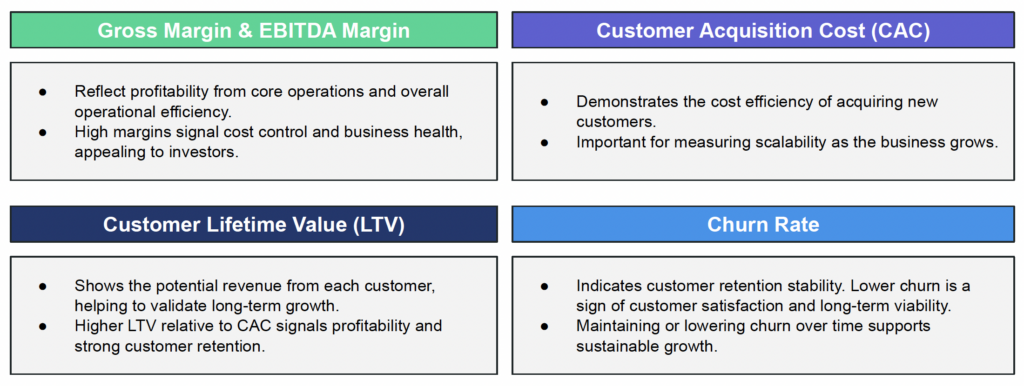

Financial Ratios and Metrics for Scalability

The financial model allows us to calculate key metrics that offer actionable insights into your business’s scalability and attractiveness to investors. Here are a few examples:

Gross Margin = (Revenue – COGS) ÷ Revenue × 100

EBITDA Margin = EBITDA ÷ Revenue × 100

Customer Acquisition Cost (CAC) = Total Sales and Marketing Expenses ÷ Number of New Customers Acquired

Customer Lifetime Value (LTV) = ARPU × Average Customer Lifespan (Months)

Churn Rate = (Customers Lost During a Period ÷ Total Customers at the Start of the Period) × 100

These metrics work together to provide a full picture of your startup’s performance. For instance, if churn increases, it impacts LTV and overall profitability. Addressing these issues early ensures steady growth.

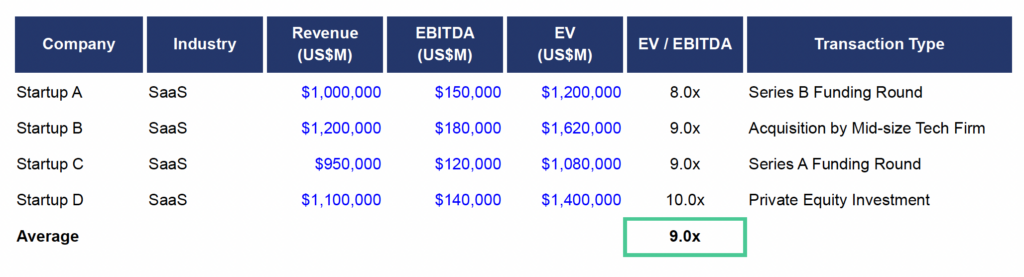

Comparables Analysis

Comparables analysis allows startups to benchmark their valuation against similar companies in the same industry. A key metric used in this analysis is the EV/EBITDA multiple, which compares a company’s Enterprise Value (EV), the total value of the company, to its EBITDA, a measure of profitability.

The EV/EBITDA multiple shows how much investors are willing to pay for each dollar of EBITDA. For example, a SaaS startup valued at 9x EBITDA indicates that its Enterprise Value is nine times its EBITDA, reflecting strong profitability and growth potential.

This multiple serves as a benchmark for startups, helping them position their valuation within market trends and ensuring they’re not undervaluing or overvaluing their business in investment discussions.

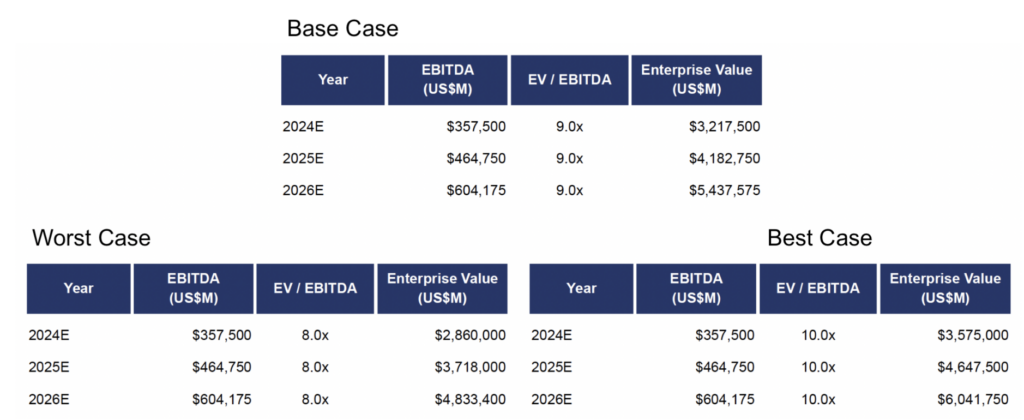

Financial Projections and Valuation Scenarios

Projections often include three scenarios:

- Best Case: Aggressive growth assumptions with high market penetration.

- Base Case: Realistic growth aligned with market trends.

- Worst Case: Conservative estimates for challenging market conditions.

Valuation Scenarios

Modeling these scenarios helps founders prepare for investor negotiations and unexpected market changes. For instance, a worst-case valuation still demonstrates that your startup has a viable path forward even in challenging times.

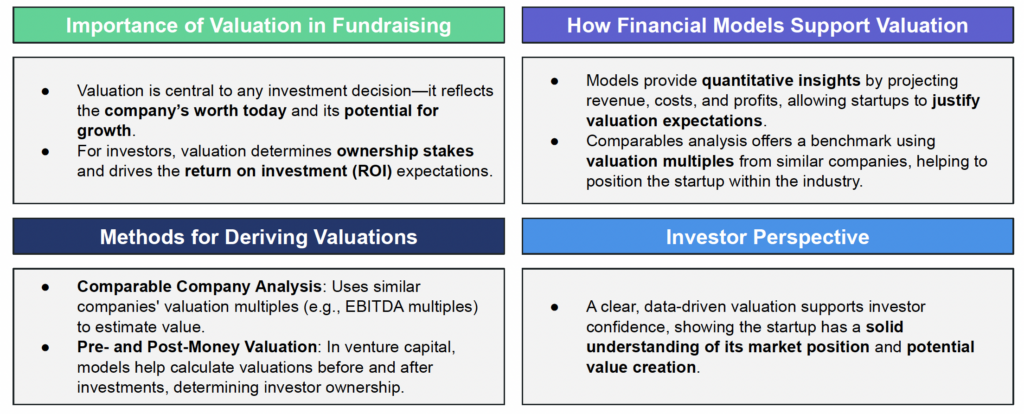

Why Financial Models Are Non-Negotiable

Building a financial model is one of the most critical steps for any startup founder. It goes beyond the numbers and tells your business’s story through data. Financial models allow you to communicate your startup’s value clearly, allocate resources effectively, and project future growth.

The importance of valuation in fundraising and the methods for deriving it are deeply intertwined with your financial model. A clear, data-driven valuation increases investor confidence and positions your startup as a credible and strategic investment opportunity.

If you feel overwhelmed by the complexity of financial modeling, Cypher is here to help. From creating projections to benchmarking with comparables, we’ll guide you every step of the way to ensure your financial story resonates with investors and supports your growth ambitions.

Build your empire—we’ll crunch the numbers. Contact Cypher today to get started.